October Newsletter Market Report

How parents impact homeownership

GTA REALTORS ® Release August Stats TORONTO, ONTARIO, September 4, 2025

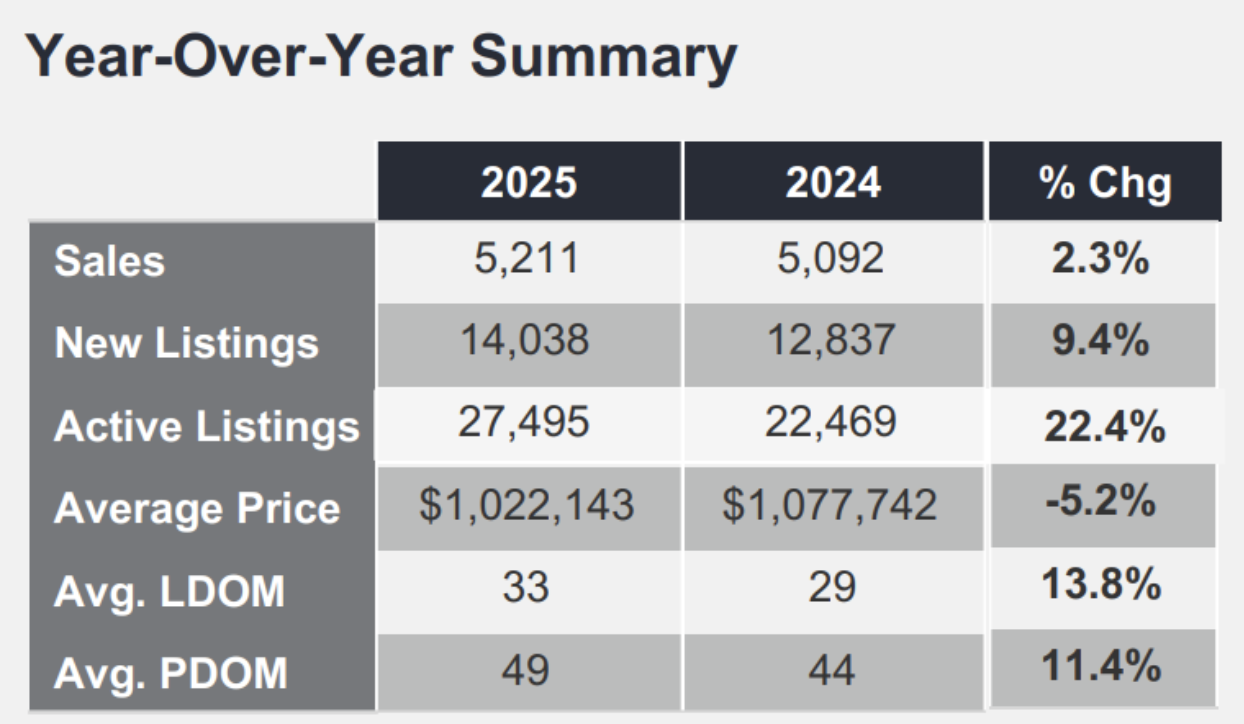

August home sales reported by the Toronto Regional Real Estate Board (TRREB) were up on a year-over-year basis. Over the same period, home buyers benefitted from an even larger increase in the inventory of listings. Average selling prices continued to be negotiated downward due to the elevated choice across market segments. Continue reading here.

“Compared to last year, we have seen a modest increase in home sales over the summer. With the economy slowing and inflation under control, additional interest rate cuts by the Bank of Canada could help offset the impact of tariffs. Greater affordability would not only support more home sales but also generate significant economic spin-off benefits,” said TRREB President Elechia Barry-Sproule.

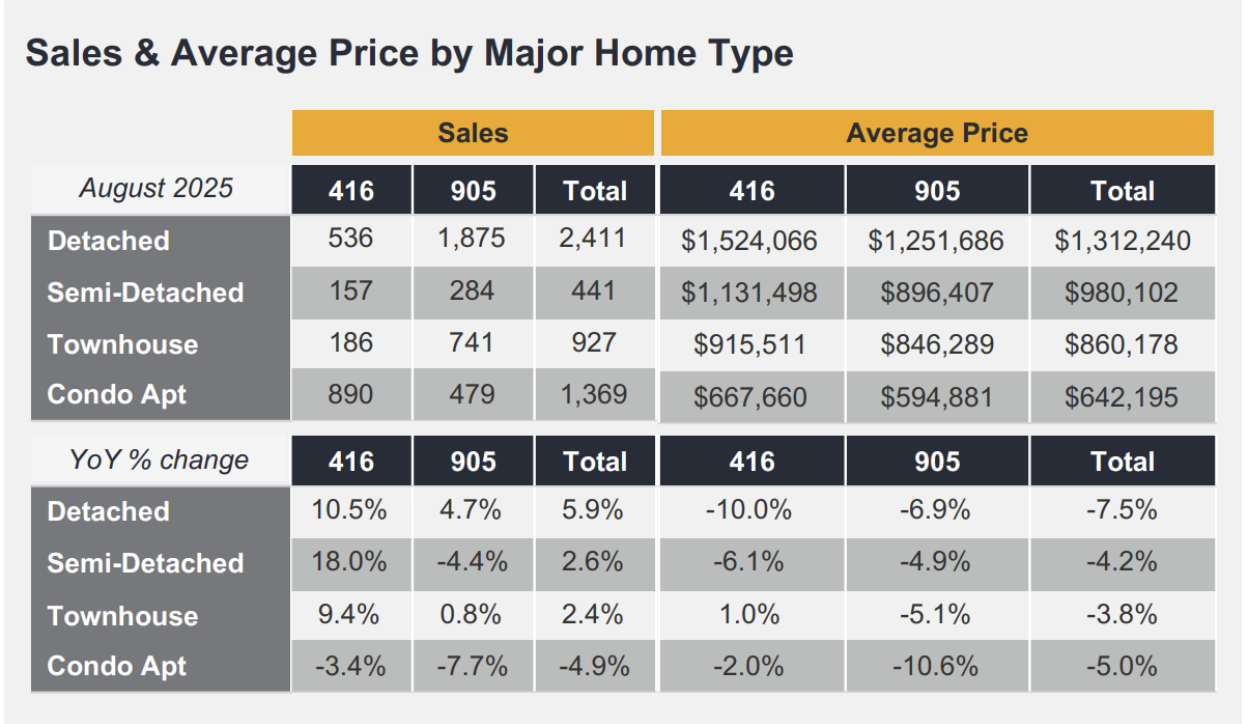

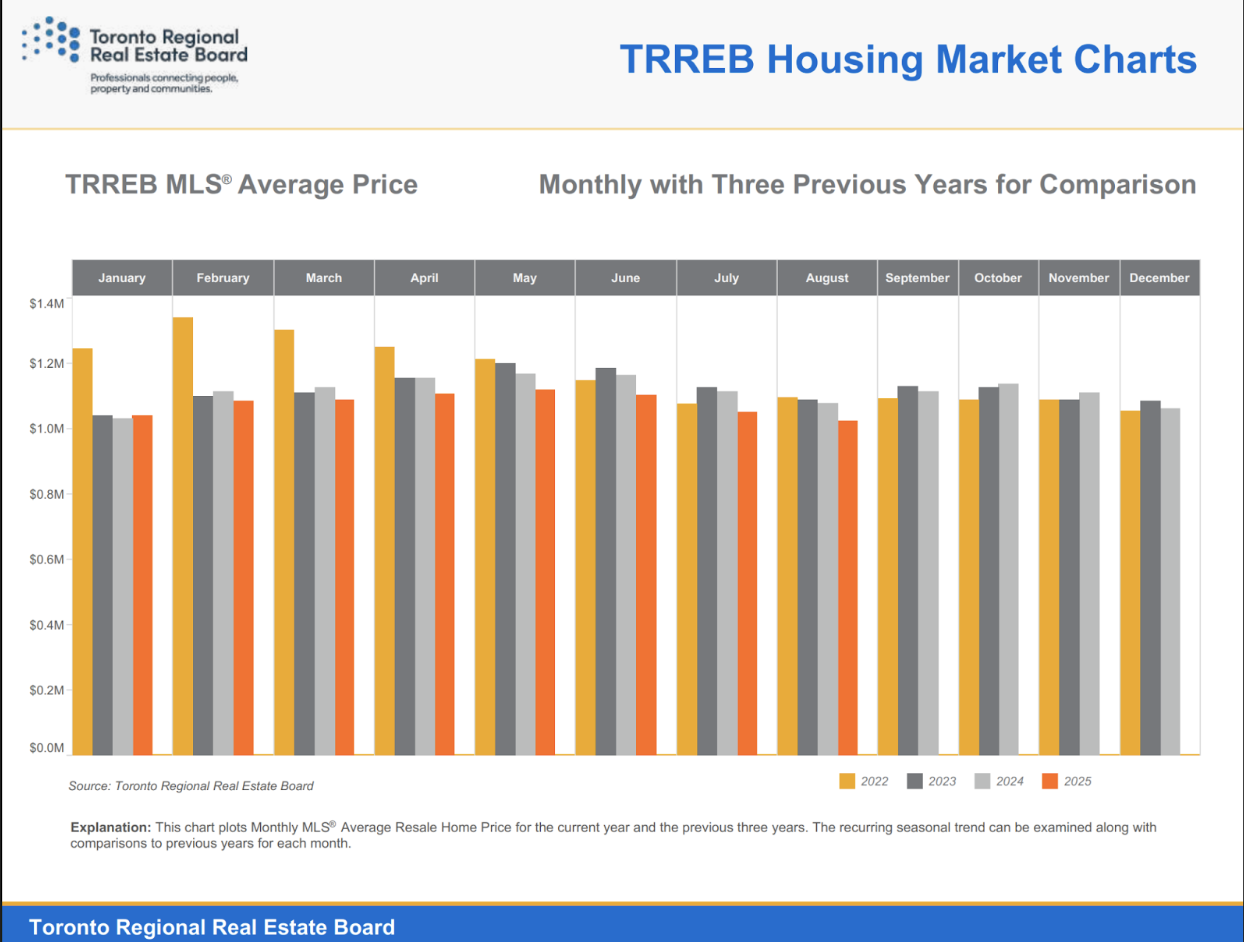

The MLS® Home Price Index Composite benchmark was down by 5.2 per cent year-over-year in August 2025. The average selling price, at $1,022,143, was also down by 5.2 per cent compared to August 2024. On a month-overmonth seasonally adjusted basis, the MLS® HPI Composite and average selling price remained flat compared to July.

“A household earning the average income in the GTA is still finding it challenging to afford the monthly mortgage payment associated with the purchase of an average priced home. This is even with lower borrowing costs and selling prices over the past year. Further relief in borrowing costs would see an increased number of buyers move off the sidelines to take advantage of today's well-supplied market,” said TRREB Chief Information Officer Jason Mercer.

What This Means for Sellers and Buyers

[Watch Here]

Don’t Let “Waiting for a Better Price” Cost You More Than You Think

If you’re age 55 or older with an empty nest, it’s natural to feel hesitant about selling your home too soon. One of the most common objections I hear is:

“I’ll wait — maybe resale values will recover again, and then I can sell at a higher price.”

That impulse makes sense. But when you dig into the data and the trade-offs, you may find that waiting is the more costly option.

Let’s walk through the key facts and what they mean for people in your position.

What the Market Has Actually Done Since the 2021 Peak

First, to set realistic expectations: the idea that real estate will simply “keep going up” hasn’t held true in many regions since 2021.

-

The peak for many Canadian markets happened in early 2022 (some point to March 2021 as a milestone in the run-up). Wolf Street+3RBC+3Wikipedia+3

-

Since that peak, many areas have seen declines of 10–20 percent (or more in some hot markets) in benchmark home prices. Global Property Guide+4Mortgage Sandbox+4Wolf Street+4

-

For example, in June 2025, Canada’s benchmark home price declined to levels not seen since mid-2021. Wolf Street

-

In some major cities, detached homes have held up marginally better than condos, though both segments are under pressure. Wolf Street+4RBC+4Wolf Street+4

-

In the Greater Toronto Area, average condo prices in Q2 2025 were down about 5.9 % compared to Q2 2024. Toronto Regional Real Estate Board

-

Nationally, the condo price index fell most steeply year over year (–7 %), while single-family (detached) homes declined about 5.6 %. RBC

In short: you’re not likely to “miss out” on dramatic upside by selling now — much of the run-up has been reversed.

Why Waiting for “Better Prices” Is Risky (Especially for Downsizers)

Sellers often assume that staying put a few more years will let them sell at a better price later. But there are three major counterweights working against that assumption — especially for empty-nesters planning to downsize (e.g. into condos or smaller homes).

1. The ten-year “normal” real estate growth is modest

Historically, long-term real estate appreciation isn’t as explosive as many hope. A rough rule of thumb is ~6 % average annual growth over long periods in many markets (before factoring in costs, taxes, maintenance, etc.). (This will vary widely by city and region.)

So if you wait for, say, 3–5 years, you’re hoping that your home will outperform that average. But if the market is stagnating or declining (as it has been), your upside is far from assured.

2. The “gap” between detached and condo is working in your favor (if you’re downsizing)

One of the most underappreciated dynamics right now: the price decline in condos is often steeper (or more volatile) than for detached homes. As a result, if you sell a detached house and buy a condo, your buying power may stretch further now than at the peak.

In practical terms:

-

Your existing home has lost some value, but detached homes haven’t collapsed as much as condos in many markets.

-

The condo you intend to buy has also dropped — sometimes more than your home — meaning your dollar goes farther in the condo market.

-

That widening gap gives you more “headroom” in your downsizing transaction than you would have had in 2021.

This is a reversal of the more common concern at market peaks, where people fear that downsizing leaves them with too little left over. In the current cooling market, the opposite may be true.

3. Opportunity cost: What you do with the proceeds matters

Even if your home appreciates modestly from here, the real question is: what would your money do elsewhere in the meantime?

Consider these points:

-

If you sell now and invest the proceeds in a balanced portfolio (bonds, equities, income assets), you may generate returns higher than the modest real estate appreciation you hope for.

-

That gives you income and flexibility rather than tying your capital up in a single illiquid asset.

-

Even if real estate recovers somewhat, time in the market (i.e. getting invested earlier) often outpaces waiting for perfect timing.

So it’s not just about “did the home go up?” — it’s about “what did your money do while waiting?”

A Hypothetical Illustration

Let’s imagine a scenario to make this concrete.

-

Suppose in 2021 your home was worth $1,000,000 (a detached house).

-

Now assume it has lost 15 % since the peak → it’s worth $850,000.

-

You sell, and after transaction costs and paying off mortgage, you net $800,000 (for example).

Now you plan to buy a condo (or smaller home) that used to cost $600,000 — that condo, however, is down 8 %, so it now costs $552,000. So with your $800,000, you buy it and still have $248,000 leftover.

Then you invest that $248,000. If that invested portion earns, say, 5 % annually (after costs) over 3–5 years, that growth may well exceed modest home price gains in that period.

Meanwhile, had you not sold, your $1,000,000 home might have declined further, or appreciated only very slowly, leaving you with less flexibility and less capital freed up for investments, travel, healthcare, or legacy planning.

What that means for downsizers

-

The market is not at the 2021/2022 highs — averages are roughly 20–25% below peak in the GTA depending on which peak and metric you use. Selling at today’s prices means accepting that decline vs the peak — but the converse is that condos have fallen materially too, which can increase your buying power when you downsize. (If the detached you sell has fallen less than the condo you buy, you may net more leftover cash than you would have at the 2021/22 peak.) outline.ca+1

-

Because you free capital when you downsize, how you invest the leftover matters — a diversified investment earning reasonable returns over several years can outperform small incremental house price gains you might be hoping for while you “wait.”

Practical considerations for 55+ downsizers (finance + lifestyle)

-

Liquidity & flexibility matter. Money invested can fund travel, health, or cash for renovations/assistance — not just price appreciation.

-

Downsizing math often improves right now. Because condo values have softened (often as much or more than low-rise values), the spread can work in your favour when you sell a house and buy a condo. Zoocasa.com+1

-

Risk & stress: Investing leftover cash reduces concentration risk (one illiquid asset) but introduces market risk — you must be comfortable with that balance.

-

Timing the market is unreliable. You can use tactical solutions (rent-backs, flexible closing dates, staged selling) to reduce emotional stress while capturing today’s buyer demand.

-

Get local, specific numbers. The averages above are for city/region: your actual home’s value, your condo-of-interest price, outstanding mortgage, tax situation, and transaction costs will change the math materially.

If you’d like help crunching the numbers, why not request a copy of our Downsizing Financial Analysis Worksheet? Free for the asking by [clicking here]

.png)

Post a comment